Loan to Value Ratio Calculator: What’s Your LTV Ratio?

Loan to Value Ratio Calculator: What’s Your LTV Ratio?

Loan to value ratio is a standard metric that lenders use to assess default risk and qualify commercial real estate loans. While it’s far from the only data point lenders consider, it’s one of the most basic and often checked early on during the loan application process.

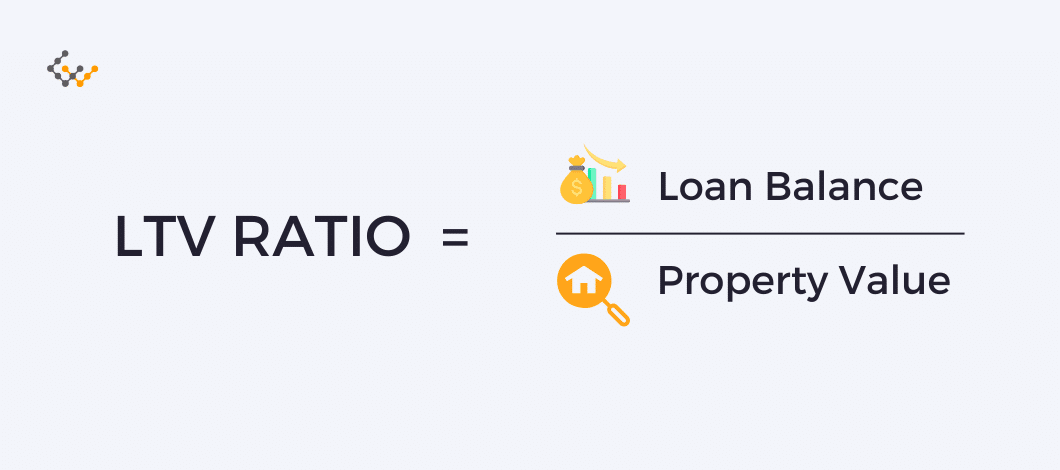

What is a Loan to Value Ratio?

Loan to value (LTV) ratio is a straightforward way to measure a commercial real estate loan’s size against the value of the financed property. The ratio is simple, yet considered one of the accurate ways to assess the risk that individual loans present.

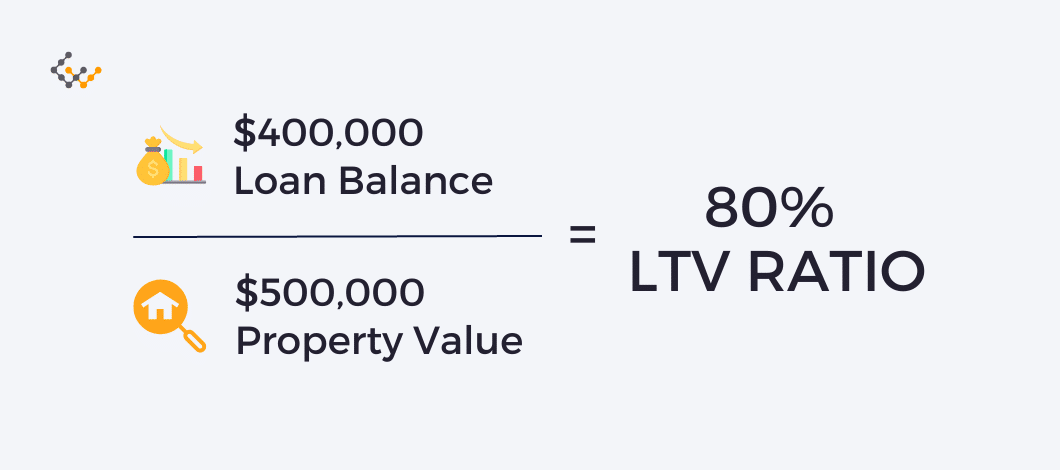

Loan to Value Ratio = Loan Balance / Property Value

For example: a $400,000 loan on a $500,000 commercial property would have an LTV of 80% ($400,000 / $500,000 = 0.80).

What Does LTV Tell You?

Lenders use loan to value ratios as a measure of the risk that different loans present. Higher LTVs are considered riskier than lower LTVs for a couple of reasons.

First, borrowers have less equity in their commercial property when the associated loan has a high LTV. Should a property become unprofitable, borrowers who have less equity may be more apt to walk away and default on their loan.

Second, properties are more likely to become underwater when their associated loan has a high LTV. Should the local real estate market crash, properties with high LTV ratios will more quickly become underwater. This not only increases the risk of default, but also may force lenders to take a loss if they foreclose and auction off a property.

In order to ensure that loans fall within their risk parameters, lenders have maximum LTVs that they’ll allow.

If borrowers know a loan program’s maximum allowed ratio, the LTV formula can be inverted to determine the maximum property value allowed or down-payment required.

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

What is a Combined Loan to Value Ratio?

When borrowers secure financing through multiple loan programs, lenders often consider the combined loan to value ratio (CLTV) in addition to the loan to value ratio.

CLTV measures all of the outstanding balances on a commercial property’s loans against the property’s value. Whereas LTV considers only one loan against the property, CLTV considers all loans that are secured with the property.

Combined Loan to Value Ratio = Σ All Loan Balances / Property Value

The combined ratio provides a more comprehensive measure when multiple loans and/or lines of credit are being used. It’s unnecessary when using only one loan.

How LTV Applies to Commercial Real Estate

Lenders appreciate how loan to value measures what portion of an investment property is financed. No other calculation considers loan balance and property value in such direct relation to each other.

Loan to Value vs. Debt Yield

Debt yield measures net operating income against loan balance, and thus shows the annual return on the amount borrowed. The metric doesn’t directly capture any property value change that results from building improvements or general market trends.

Because loan to value includes a property’s value within its calculation, LTV will capture any changes in property value that result from improvements or market trends.

Loan to Value vs. Debt Service Coverage

Debt service coverage ratio (DSCR) focuses on interest rates and amortization schedules. This metric is almost entirely insulated from changes in property value.

Loan to value doesn’t assess the financials of a loan itself in the same way that DSCR does, but instead examines the loan’s amount as it relates to the property.

Loan to Value vs. Cap Rate

Cap rate measures a property’s net operating income against the property’s value. While this is needed to assess how profitable a property is, it doesn’t say anything about the property’s financing.

Loan to value uses the same property value data point, but examines the property’s financing rather than its income.

What is an Acceptable Loan to Value Ratio?

Most commercial real estate loan programs allow a maximum loan to value ratio of 75-80%, but some programs differ from this range. Special federal loan programs (e.g. HUD/FHA 223(f)) allow ratios of 83.3-90%. Some private loans will only permit 65-70%.

Additionally, a few specialized programs (e.g. Freddie Mac Green Advantage) may amend the maximum LTV slightly. Any such amendments are usually specifically so that investors can install environmentally friendly or similar improvements.

While qualified investors can take advantage of a program’s maximum allowed LTV, sometimes it’s advantageous to reduce the LTV in order to get a lower interest rate.

Certain programs minorly reduce the interest rate when a borrower has more equity in their property. Even if such reductions are minor, the cumulative savings can be substantial considering the time and duration of commercial real estate loans.

How to Calculate LTV

The borrowed amount and property value are needed to calculate the loan to value ratio. A property’s appraised value is most often used, which is one reason why lenders typically require a recent appraisal during underwriting.

The formula to calculate LTV is:

Loan to Value Ratio = Loan Balance / Property Value

As another example, consider a $1.2 million property that’s being financed with a $1 million loan. The LTV would be 83.3%, and a specialized loan program that allows 80+% LTVs would likely be needed (1,000,000 / 1,200,000 = 83.3%).

The formula can be inverted to determine the maximum permitted loan balance or property value:

Property Value = Loan Balance / LTV ratio

Consider a borrower who knows they can qualify for a $350,000 loan through a program that allows a maximum LTV ratio of 75%. The borrower would be able to purchase a property worth up to about $467,000 ($350,000 / 0.75% = $466,667).

How to Use LTV for Commercial Real Estate

Loan-to-value ratios must be met in order to qualify for commercial real estate loans. A good loan to value ratio typically falls within the range of 75-80%. After checking a loan program’s maximum LTV, the formula can be used to determine:

- Whether a loan application will be denied based on this criterion

- What the maximum property value that an investor can purchase is

- What down-payment will be required for the purchase of a property

The maximum allowed LTV should be checked early on in the loan application process, so the borrower can check other loan programs if necessary and can determine what their purchasing parameters are.